Hey, friend!

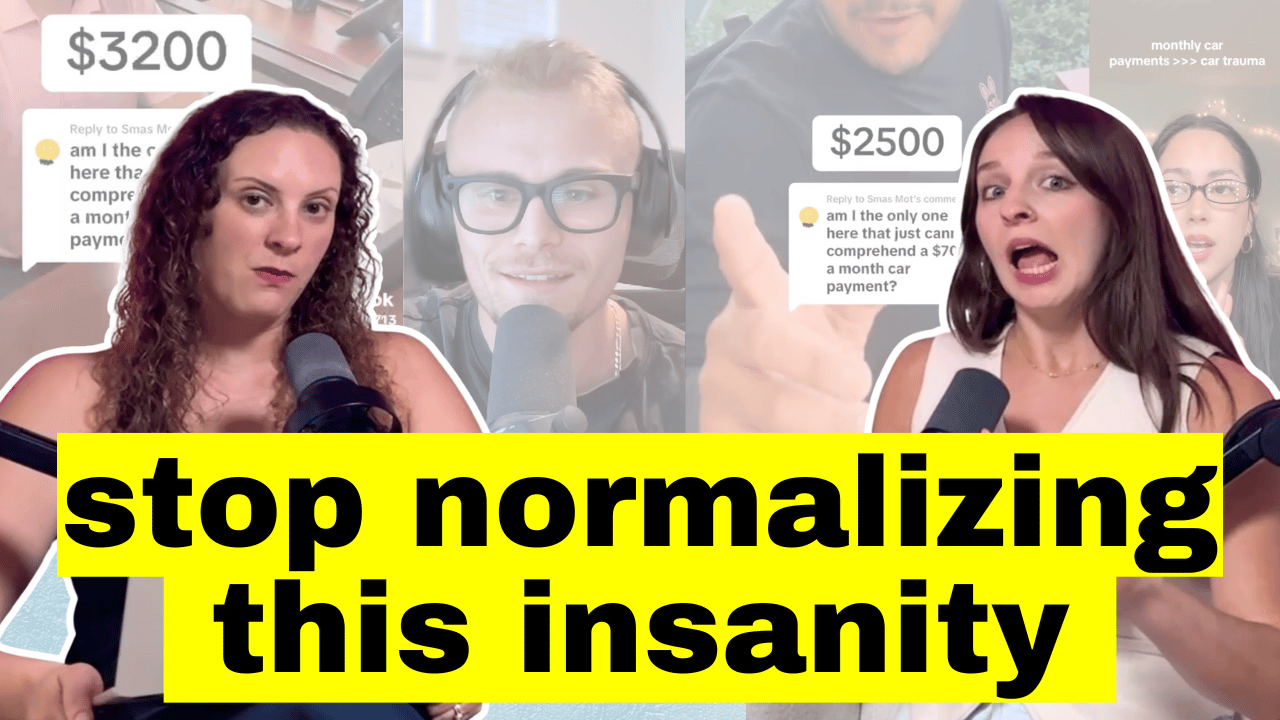

Have you noticed the steady increase in what people are willing to spend on their car payment? When did $800+/mo become standard??

💡 Here’s something to keep in mind: Your car payment should ideally be no more than 10–15% of your take-home pay.

Go beyond that, and you’re likely sacrificing your ability to save, invest, or even cover basic expenses comfortably.

We just released a YouTube episode that’ll help you think through what’s truly best for you when it comes to car buying.

🚘 What TikTok Won’t Tell You: What To Do BEFORE You Buy

1. Buy based on your budget, not the monthly payment.

That $600/month might seem doable, but it doesn’t reflect the actual cost of the car.

Always look at the total cost to own: purchase price, interest, insurance, maintenance, and depreciation. That’s what actually impacts your budget long term, not just what comes out this month.

2. Negotiate, negotiate, NEGOTIATE!

Dealerships have different fees, add-ons, and taxes depending on where you go. This is your chance to knock that pesky $500 service charge off, or negotiate down the “processing” fee.

Make sure you do this before you tell the dealership about your trade in or down payment. Don’t show your hand before you’ve played the game, sista.

Want to learn more about negotiation strategies and HOW to get the best price on a used car? Tune in on YouTube, Spotify, or Apple Podcasts.

Read this before you go.

Are you looking for calmer ways to move through a chaotic world? The MyWellbeing Newsletter delivers free, therapist-informed wellness tips every week – helping you navigate stress, overthinking, and everything in between with more clarity and care.

Subscribe here to simplify your day! **

Get More!

📢 There’s only a few days left to get our Annual Finance Planner for 50% off!

You won’t want to miss this mobile-optimized ticket to an organized life – perfect for those that are health-conscious or eco-friendly.

Between a benefits tracker, a schedule for annual wellness exams, & a travel rewards tracker, it has it all. Right now, use code SUMMER50 for a deal that will save you major $$$.

⭐ Back-to-school is right around the corner, which means that summer is almost at its end. Thankfully, we’ve got a ✨ Glow-Up Giveaway ✨ to help us send July packing!

Featuring helpful digital resources by our fave personal finance whizzes, annnd a $1,000 cash prize, this giveaway is a must.

Warmly (literally, July is HOT),

Kim

**Means this is a sponsored or affiliate section. We may earn a small fee or commission when you choose to try one of our sponsor or affiliate partners. But opinions are still 1000% our own.